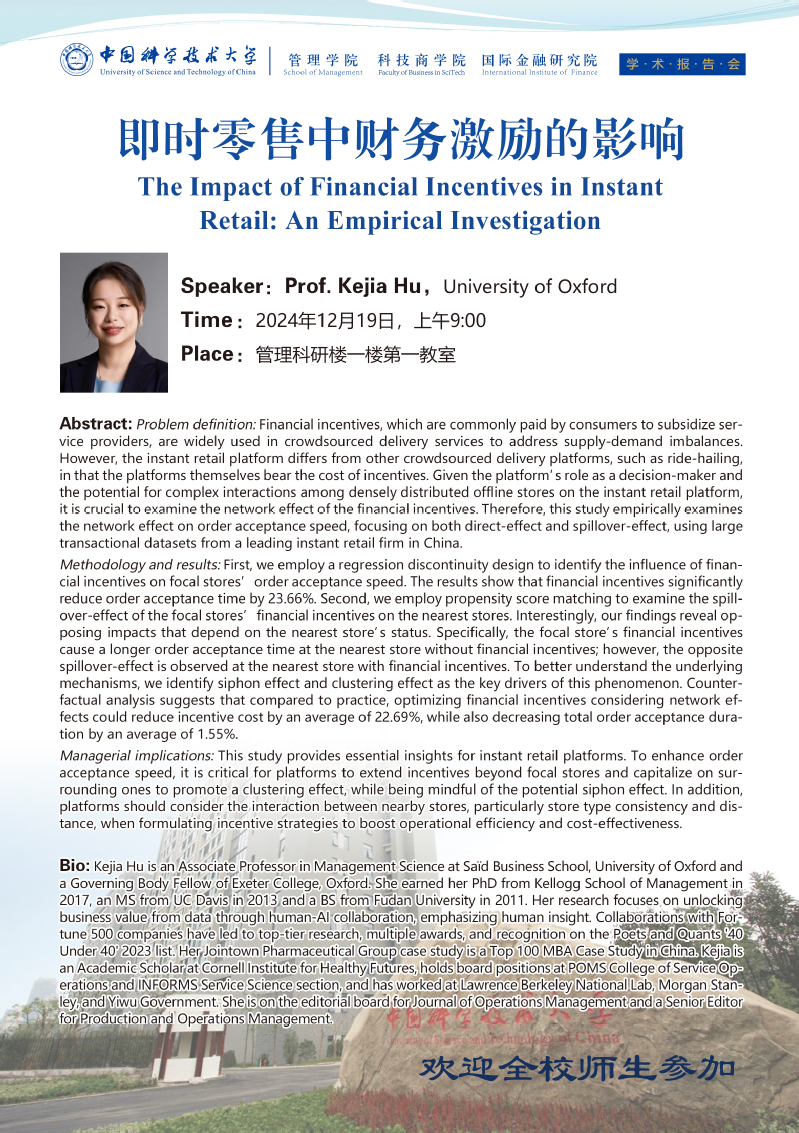

报告人:Prof. Kejia Hu, University of Oxford

时间:2024年12月19日,上午9:00

地点:管理科研楼一楼第一教室

本次讲座将在B站和蔻享学术同步进行:

B站:https://live.bilibili.com/26422082

蔻享:https://www.koushare.com/live/details/39614

Abstract: Problem definition: Financialincentives, which are commonly paid by consumers to subsidize serviceproviders, are widely used in crowdsourced delivery services to addresssupply-demand imbalances. However, the instant retail platform differs fromother crowdsourced delivery platforms, such as ride-hailing, in that theplatforms themselves bear the cost of incentives. Given the platform’s role asa decision-maker and the potential for complex interactions among denselydistributed offline stores on the instant retail platform, it is crucial toexamine the network effect of the financial incentives. Therefore, this studyempirically examines the network effect on order acceptance speed, focusing onboth direct-effect and spillover-effect, using large transactional datasetsfrom a leading instant retail firm in China.

Methodologyand results: First, we employ a regressiondiscontinuity design to identify the influence of financial incentives on focalstores’ order acceptance speed. The results show that financial incentivessignificantly reduce order acceptance time by 23.66%. Second, we employpropensity score matching to examine the spillover-effect of the focal stores’financial incentives on the nearest stores. Interestingly, our findings revealopposing impacts that depend on the nearest store’s status. Specifically, thefocal store’s financial incentives cause a longer order acceptance time at thenearest store without financial incentives; however, the oppositespillover-effect is observed at the nearest store with financial incentives. Tobetter understand the underlying mechanisms, we identify siphon effect andclustering effect as the key drivers of this phenomenon. Counterfactualanalysis suggests that compared to practice, optimizing financial incentivesconsidering network effects could reduce incentive cost by an average of22.69%, while also decreasing total order acceptance duration by an average of1.55%.

Managerialimplications: This study provides essentialinsights for instant retail platforms. To enhance order acceptance speed, it iscritical for platforms to extend incentives beyond focal stores and capitalizeon surrounding ones to promote a clustering effect, while being mindful of thepotential siphon effect. In addition, platforms should consider the interactionbetween nearby stores, particularly store type consistency and distance, whenformulating incentive strategies to boost operational efficiency andcost-effectiveness.

Bio: Kejia Hu is an AssociateProfessor in Management Science at Saïd Business School, University of Oxfordand a Governing Body Fellow of Exeter College, Oxford. She earned her PhD fromKellogg School of Management in 2017, an MS from UC Davis in 2013 and a BS fromFudan University in 2011. Her research focuses on unlocking business value fromdata through human-AI collaboration, emphasizing human insight. Collaborationswith Fortune 500 companies have led to top-tier research, multiple awards, andrecognition on the Poets and Quants '40 Under 40' 2023 list. Her JointownPharmaceutical Group case study is a Top 100 MBA Case Study in China. Kejia isan Academic Scholar at Cornell Institute for Healthy Futures, holds boardpositions at POMS College of Service Operations and INFORMS Service Sciencesection, and has worked at Lawrence Berkeley National Lab, Morgan Stanley, andYiwu Government. She is on the editorial board for Journal of OperationsManagement and a Senior Editor for Production and Operations Management.